Leaders become Laggards

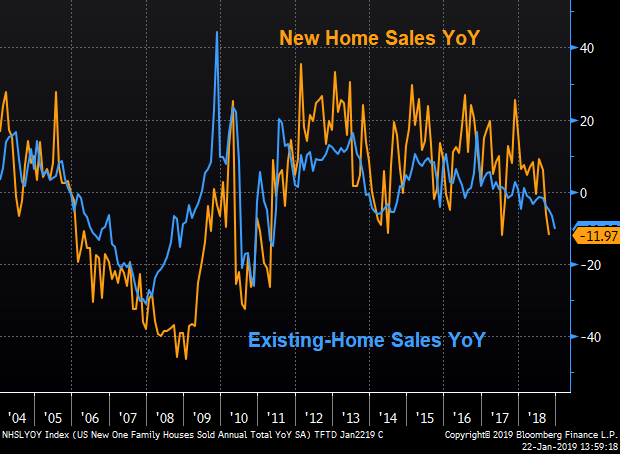

Today saw the release of the National Association of Realtors’ Existing-Home Sales data. As an article on the NAR’s website put it, “After two consecutive months of increases, existing-home sales declined in the month of December”, and “None of the four major regions saw a gain in sales activity last month”. This is the mild version of the underlying data. Sales were down 10.3% from a year ago, even as the median price change in YoY terms was the lowest it has been all year.

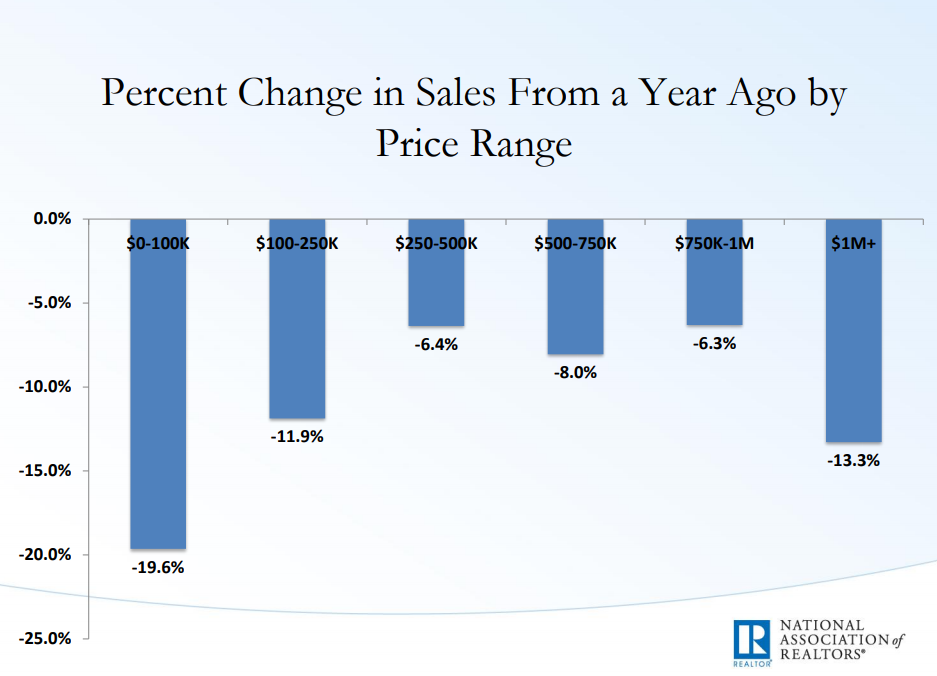

Additionally, some of the regional patterns are troubling. While the western US had seen some of the strongest price growth, as we highlighted previously, existing-home sales in the West dropped 15% from where they were a year ago, and the median price grew a paltry 0.2%. There are, however some reasons to be optimistic. As Lawrence Yun of NAR said in the NAR article, “Softer sales in December reflected… activity in previous months when mortgage rates were higher than today. Now, with mortgage rates lower, some revival in home sales is expected going into spring”. Ivy Zelman reiterated this idea in an interview on CNBC. She pointed out that the data is basically three months old and “is really a response from what had been a spike in rates”. She was in fact optimistic, believing we still “have the backdrop of a very healthy housing market”, but clarified that “housing is actually really a tale of two markets” where the affordable segment is healthy, but the high-end “is more challenging”.

“It’s a one-two punch”

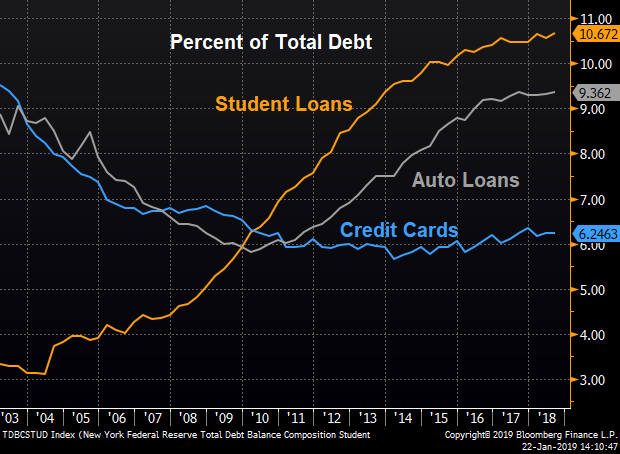

As researchers have looked for reasons why homeownership among Millennials has lagged historical levels, recent research from the Fed puts some of the blame on student loans. The research finds that “a little over 20 percent of the overall decline in homeownership among the young can be attributed to the rise in student loan debt”. An article in the Wall Street Journal highlighted this research and covered the student loan vs homeownership Catch-22. On the one hand, as Ralph McLaughlin of CoreLogic said, “Basically the only way to get your foot in the housing door is to have a degree” as degrees are generally accompanied by a wage boost. However, at the same time, as Skylar Olsen of Zillow said in the WSJ article, student loans and rising home prices are “a one-two punch”. While this seems to signal long-term slowness in homeownership growth among Millennials as they continue to pay off their loans, it does offer some hope that things could be improved in the housing market should policy makers successfully wrestle the beast of ever-expanding student-loan debt.